The All-In Pod Exposed The Trump Tariffs

Larry Summers & Ezra Klein were too much for the besties

The All-in Podcast, the #1 most popular weekly technology podcast is a must-watch, for everyone from aspiring tech & finance bros, to key policy makers in Washington. Viewers tune in each week to hear the perspectives of the four besties on trends related to technology, politics and science.

These besties are:

David Sacks, a PayPal Mafia alum who went on to co-found Yammer (sold to Microsoft), build a name as a tech-savvy political operator, and now serves as the AI & Crypto Czar for Trump administration.

Chamath Palihapitiya, a former Facebook executive who helped scale its growth engine before founding Social Capital, and launching a series of Special Purpose Acquisition Vehicles (SPACs).

Jason Calacanis, an angel investor known for his early bets on Uber and Robinhood. He serves as the moderator for the podcast.

David Friedberg, former Googler, who sold his startup to Monsanto, now the CEO of The Production Board, and often the podcast’s authority on topics related to science.

The podcast started during the early days of the pandemic, as a way for the besties stay in touch during the lockdown. The episodes have a loose structure and a simple premise: the besties, sometimes joined by a guest or two, have a mostly unedited discussion for an hour or so, touching on a variety of different topics. Jason serves as the moderator, and often the foil to Sacks or Chamath when the topics get political.

This has increasingly happened since President Trump re-emerged as a contender for the White House, eventually Sacks and Chamath became involved with the campaign. After Trump’s victory, Sacks joined the administration, as such he no longer appears on every episode. Nonetheless, even in his absence, the podcast has noticeably become more political these past months, usually airing more on the side of President.

Last week’s episode reached a new level when Sacks & Chamath decided to go head to head on with former treasury secretary Larry Summers and political commentator Ezra Klein to debate Trump’s tariff policy. At the onset, it looked like viewers were about be treated to a productive discussion among two connected insiders from the Trump administration, and two well respected moderate Democrats.

Instead what followed was a 2 hour smackdown that not only further confirmed the concerns of many critics of these policies, and exposed two of the besties.

Let’s recap the debate. (Long Article Alert)

But first, make sure to hit the Subscribe button below to join the nearly 1,000 Subscribers that get articles like these, delivered directly to their inbox.

If this week’s article does not interest you, please check out some other recent ones:

Tale of the Tape

Larry Summers served as Treasury Secretary under President Bill Clinton, then president of Harvard from 2002-2006 (He was the president, the Winklevoss twins go to visit in The Social Network), and held many other esteemed titles during his long career. He has notable ties to the business and technology world, he briefly served as a the Managing Partners at D.E Shaw, a prominent hedge fund and one of his proteges was none other than former Google and Facebook executive, Sheryl Sandberg. He serves on the board of OpenAI. Long story short, he’s a lifelong democrat but nobody would accuse him of being “woke” or anti-business. Summers spoke at the 2023 All-in Summit, so it’s not as though he’s not on friendly terms with the besties.

Ezra Klein is a journalist and political commentator, known for co-founding Vox and his regular appeares on major news networks going back decades. Klein, like Summers, is a Democrat but more progressive. He’s been on an extended podcast tour for his latest book Abundance, which in part criticizes Democrats, for not being able to accomplish their own agenda because of red-tape, they themselves created. Check this great clip between him and Jon Stewart:

The Debate

After the initial cordial niceties were exchanged, the dynamic quickly shifted when Summers expressed his dissatisfaction with the Trump administrations trade policy, specifically relating to tariffs. He hit President Trump and his advisors with sharp criticism, failing to see how their actions would help Americans.

Sacks said drastic measures were needed offset the trade balance with China. He blamed Summers and Clinton for allowing China into the World Trade Organization (WTO), which is what was responsible for hollowing out the Midwest manufacturing base. Summers, understandably did not take kindly to this criticism, and challenged Sacks or anybody on the podcast to name one good China could export to the US, they already could not before they joined the WTO. He would ask this question repeatedly, but neither Sacks or Chamath could ever directly answer this.

This would largely set the tone for the remainder of the episode. Sacks or Chamath would talk in general terms, about the problem the administration is trying to solve, the large trade imbalance and the US supply chain being completely reliant on China for key goods. Every now and then, Sacks would antagonize Summer’s by bringing back up his role in normalizing trade relations with China.

In turn, when Summers wasn’t arguing with Sacks about the legacy of China’s admission to the WTO, he and Klein would point out Chamath and Sacks were largely relying on personal anecdotes or were unable to answer basic questions about what success would look like? This is why they got the better of Sacks and Chamath. The bestie’s arguments did mostly rely on generalizations, personal anecdotes, or attacks against Democrats. Seeing as the initial reaction to the tariffs has been overwhelmingly negative, the burden to prove the policies were a good thing fell on the besties. They were in tough spot and they failed to deliver.

The net result was it made Sacks or Chamath look weak on their policy knowledge or they were so concerned with staying in the President’s good graces, they are willing to abandon any sense of objectivity. Given how normally articulate the besties are, it seems more like the latter, which confirms what their critics have been saying for months. We can still enjoy the show for its great insights on business, technology and the 3 minutes they give to Friedberg for science corner, but when it comes to politics, they are no different than any other cable news show.

For the remainder of this article, I will break down some of the key points of the debate and why Summers and Klein got the better of the besties.

The Legacy of China entering the WTO

Not sure if this was for clout or a diversion tactic but Sacks was intent on taking Summers to task about his role in admitting China into the WTO. As Klein and Calacanis both pointed out, what is the value in arguing over policies made 25 years ago? Especially when everyone on the podcast agrees the US should try to reduce their reliance on China today.

Nonetheless, it happened but depending on the political affiliation of the people watching the debate, they have a different perspective who won. Those sympathetic of Sacks and the tariffs, frame the episode as Sacks “owning” Summers. Those in the other camp, saw Sacks coming off as a typical talking head you would find on a mainstream news network.

Summers said accusing him or Clinton for jobs disappearing to China was non-sensical since they did not allow anymore goods to flow into the US than were previously allowed. This is why he challenged Chamath or Sacks to name something, and neither could. Summers said the addition of China into the WTO, forced them to make certain commitments to respecting intellectual property rights and other concessions that helped out the US.

Sacks said the issue was prior to their admittance to the WTO, China had Most-Favored-Nations (MFN) status that had to be renewed on an annual basis, their inclusion to the WTO made it permanent. This gave American companies, encouraged by McKinsey to offshore everything to China, which hollowed out the American manufacturing base.

Effectively Summers argument was, everyone agreed this was the direction things were heading in, formalizing the arrangement gave the US an opportunity to get certain concessions from China. Sacks seems to believe if the US did not allow them into the WTO, it could have kept more manufacturing jobs in the US or resulted in smaller trade deficit with China.

Summers did not accept culpability for the outcome of the trade policy. Sacks did not hold him solely responsible, since every administration followed a similar tactic. In any case, it’s undeniable that trade between China increased dramatically in the past 25 years, and most American companies outsourced manufacturing to lower cost countries.

This prompted Summers to ask why Sacks and Chamath so obsessed with trade deficits? He pointed out that he personally runs a massive trade deficit with his grocery store, but that doesn’t mean he’s being exploited. Neither Sacks nor Chamath offered a convincing rebuttal. After all, the U.S. still produces and consumes a large share of its own goods and services. When American consumers save money by buying cheaper imported goods, those savings can be redirected into spending on domestic services or investing in U.S. companies. In that context, a trade deficit doesn’t necessarily mean the economy is losing, it might just be allocating resources differently.

Still, the loss of manufacturing jobs across the country has undoubtedly had a negative impact, therefore whether it’s because of Summers, Clinton or another administration, it’s largely irrelevant anyway. Sacks and Summers were both kind of right and wrong at the same time. It’s strange they spent so much time on this topic.

Stock Market Performance

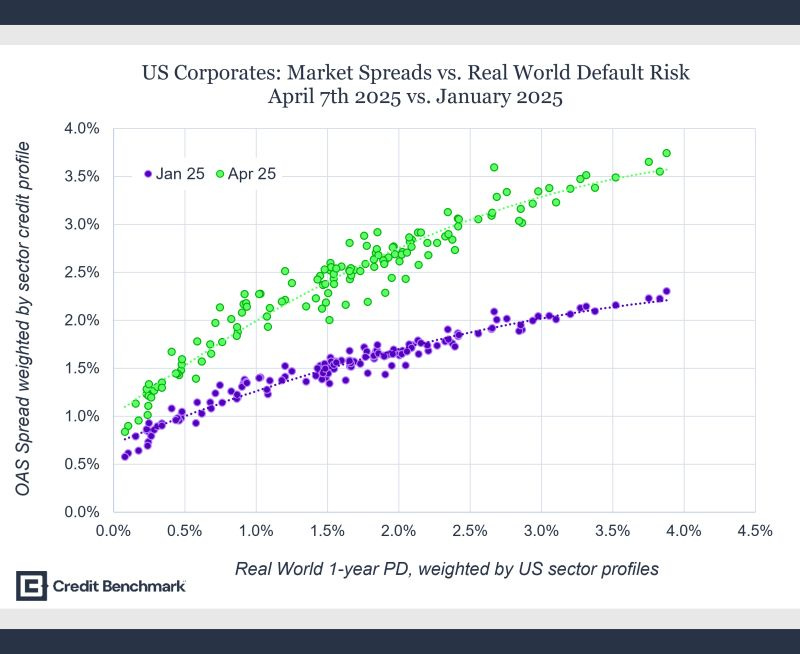

Another baffling moment early in the debate came when Summers noted that markets were reacting negatively to the proposed tariffs. Chamath attempted to dismiss the concern with a long explanation of how markets work, but the argument seemed muddled. At one point, he appeared to suggest that the selloff was a good thing. He claimed the market remained near all-time highs and blamed weak credit markets on a large hedge fund position from Japan, rather than on broader investor sentiment.

Klein and Summers were polite enough not to press too hard, but Chamath’s logic was difficult to follow. A more straightforward explanation might have been that markets are reacting to uncertainty, and while this hasn't yet shown up in earnings, short-term volatility often reflects shifting investor expectations. He could have acknowledged that the market acts as a forward-looking mechanism and that some initial instability is expected when new, untested policies are introduced.

Chamath also tried to spin a brief market rebound as a sign of strength. As a seasoned investor, he surely knows this is a weak argument. A 15 percent drop followed by a 15 percent rebound does not return the market to its previous level. As of the close on Friday, April 11, the S&P 500 stood at 5,363—down 5 percent from the April 1 open of 5,633. Over the past six months, since Trump’s electoral victory, the index is down 8.5 percent. The Dow is off 6.6 percent, and the Nasdaq is down nearly 10 percent.

A rebound may feel good in the moment, but it does not suggest that markets are confident. In fact, this pattern resembles what traders call a "dead cat bounce," where an asset briefly recovers during a broader downward trend before falling again. By next week, markets could fall even further. While I don't claim to be a market forecaster, it’s clear that short-term fluctuations offer little insight into the long-term impact of these policies.

Summers also pointed out something Chamath seemed to overlook. One of the clearest signals of investor confidence is a country’s currency. If tariffs were making the U.S. more attractive economically, you would expect the dollar to strengthen as investors moved capital into the country or sought out U.S. treasuries as a safe haven. That’s not happening. In fact, the Canadian dollar has strengthened to 0.72, its highest level since Trump took office. The euro and pound have also gained ground. None of these countries have adjusted their central bank policy rates in recent weeks, which makes the movement in currencies even more telling.

The takeaway is simple: global investors want to hold fewer U.S. dollars, which suggests declining confidence in the direction of the American economy.

Throughout the episode, Chamath relied heavily on personal anecdotes. For someone who often boasts about his deep understanding of financial markets, he struggled to offer a credible explanation when Klein or Summers asked the obvious question: Why are markets reacting negatively to these policies?

What Does Success Look Like?

Likely the most important part of the episode was when Ezra Klein asked the simple but powerful question to the besties. What metrics would they look at 2 years from now, to say that the Trump Tariffs and overall economic agenda was successful? It took a while to hear an answer since Sacks was more interested in debating Summers about the Clinton administrations role in China’s access to global markets. Eventually Chamath responded that success would involve the United States successfully onshoring four critical industries:

The AI supply chain

Energy

Critical minerals and rare earths

Semiconductors

He argued that bringing these sectors back to domestic production would enhance national security, reduce dependency on foreign supply chains, and position the U.S. for long-term economic resilience.

It qualified as a response but it didn’t answer Klein’s question. None of these are metrics. Either side could argue failure or success two years from now, this is why Klein wanted a simple metric, they could look at 2 years from now.

Seeing as David Sacks is one of the kings of SaaS metrics and Chamath has run multiple investment funds, you would think this was a softball question for them. Neither was willing to offer up an actual metric. If you parse through their comments through the episode, you can give them an out by saying DOGE will reduce government spending significantly, which by definition lowers GDP, unless consumption, investment and/or net exports offset this drop by the same amount. The Trump administration’s economic actions will likely lower GDP in the short term, the question is, if two years is enough time for other parts of the economy to offset this decline?

Their theory is that American companies will re-shore jobs and production, but that requires massive capital expenditures. Those don’t happen overnight. Projects of that scale take years, not months, to play out. Is 2-4 years a long enough time for any of this to actually happen?

What this largely revealed, and Klein pointed this out, was that depending on which person you speak with from the administration, the tariffs are trying to achieve something different. Some are taking the Sacks & Chamath line, that it’s about re-shoring. Others will say it’s to take the proceeds from the tariffs to reduce the deficit. Others will say it’s simply a bargaining chip to extract better trade deals. Chamath and Sacks did little to dispel this notion, that the administration lacks a unified view.

The silver lining from this discussion was that Klein, Summers, Sacks, and Chamath all agreed on the broader goal: the U.S. should be strengthening its position in key industries like semiconductors, energy, and critical minerals. Klein pointed out that the Biden administration did try this as well, it just didn’t get far, largely due to the kind of regulatory red tape Democrats themselves put in place. His point was not that Democrats oppose the goal, but that the execution is what failed. He sees the Republicans making a similar blunder by using heavy handed tariffs policies.

Doing Bad Things Quickly

Summers raised a key point: if the Trump administration’s goal was to shield American companies from unfair competition by state-sponsored firms in countries like China or Germany, they could have implemented anti-dumping measures or other targeted policies. Instead, they rolled out broad-based tariffs that hit many countries with no connection to the issue.

Chamath and Sacks wanted Klein and Summers to acknowledge that this administration is at least taking action. In their view, the Biden administration was slow, bogged down by bureaucracy, and largely ineffective. Sacks and Chamath argued that the Trump administration was finally doing something, even if the methods were imperfect.

Klein did not believe the administration deserved credit for doing the wrong things quickly. In his view, the current approach is neither coherent nor consistent. He compared it to the Iraq War, where many supporters of the invasion had conflicting motives. That ambiguity allowed people to project their own goals onto President Bush’s policy, believing he was acting in service of their specific concerns. The problem, according to Klein, is that without a clear and shared vision, the risks escalate dramatically. Policies like this, with serious geopolitical consequences, require surgical precision. Instead, what we’re seeing is blunt force. And that, Klein warned, is dangerous.

Klein and Summers also tried to take the besties to task for what they feel is Trump behaving like a lone gunman negotiator. Instead of a fair and transparent trade policy, they perceive his approach as taking meeting or phone calls with country or business leaders on an individual basis strike bargains at random. Their point, was perhaps the President can get some good temporary conciliations from countries or businesses desperate to avoid tariffs in the short term, but these players will certainly look to for new alternatives in the medium and long term. This hurts the credibility of the US as a place to do business and trading partner, which is more valuable than a 10% tariff.

Chamath and Sacks did not have strong responses to these concerns.

Conclusion and So What?

In the end, Summers and Klein made Chamath and Sacks look more like apologists for the Trump administration than the sharp, accomplished business leaders they usually present themselves to be. Throughout the episode, the All-In besties rarely used hard data or objective arguments to support their views. Instead, they leaned heavily on personal anecdotes drawn from their own experiences that are impossible to fact check or extrapolate from. As such, Summers and Klein made the better case against President Trump’s tariffs and the way he has conducted trade policy.

This was one of the best episodes of the All-In Podcast in recent memory, but it might also mark a turning point. One poor debate performance shouldn't define anyone, but this one revealed something many critics have been saying for a while: that Sacks and Chamath are starting to sound less like independent thinkers and more like partisan surrogates.

This creates a credibility gap. It’s hard to take Sacks and Chamath seriously when it’s clear they are unlikely to criticize Trump on their own show. To their credit, they did invite Summers and Klein on and gave them a real platform to debate. That alone sets the episode apart and makes it one of the most substantive pieces of content about Trump’s economic policies in recent weeks.

Still, the result was not flattering. The besties did not look prepared, nor did they offer convincing arguments. What they returned to repeatedly was the idea that the U.S. needs to own the supply chain in critical industries and that it is too hard to do business in America. Those are real concerns, but does not explain why the current administration needed tariffs to address them. At a moment when clarity and credibility are critical, the besties delivered neither. In doing so, they may have only reinforced the growing skepticism around Trump’s trade agenda, and lessoned the hard earned trust they built with their audience. This is their most important asset for a podcast like theirs, and they spent it, to avoid upsetting the President.

If you liked this article please Subscribe below. Each week I publish an article on a wide range of topics from business, finance, books, films, current events or anything on my mind. My articles are not usually this long.

I doubt any of the besties will read this article, if they do, they will probably call me wrong, stupid, a hater or many other things.

You can find them on Substack below:

(they are much more active on Twitter/X)

Not clear to me that Sacks has done anything but carry water for this administration, and be a general clownish ghoul

Had been planning on watching the All-In episode, so glad to read this thorough summary.

The loyalty Sacks and Chamath towards Trump is unsurprising; Trump doesn't tolerate dissent. Even Elon has only been critical of Navarro, not Trump, who is actually implementing Navarro's ideas.

The fact is that nothing is going to stop Trump from implementing policies based on his worldview 40 years ago https://www.youtube.com/watch?v=GZpMJeynBeg

The saddest part about this overall tariff war is seeing the loss of American soft power and credibility globally--something that took decades and generations to accumulate.

Market and USD weakness can be great as a long-short trader, but can't help but feel those profits are coming at the cost of America's reputation and future.