We are entering a recession (or something worse!)

Can the rich alone keep the economy going?

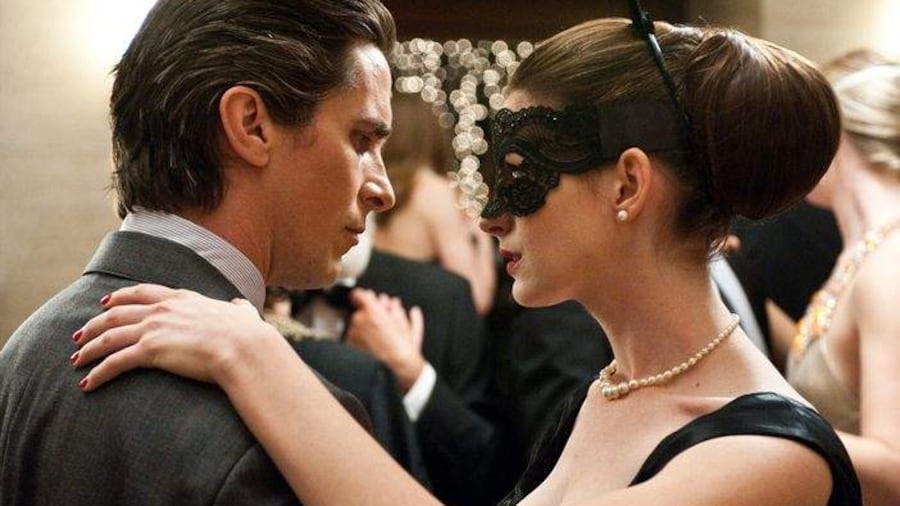

“There’s a storm coming, Mr. Wayne. You and your friends better batten down the hatches, ’cause when it hits, you’re all gonna wonder how you ever thought you could live so large and leave so little for the rest of us.” — Selena Kyle (Anne Hathaway) The Dark Knight Rises

Nobody can confidently predict how the economy will look 12 or 18 months from now. Economies are highly complex systems with many players involved and indicators are generally lagging, which is why macroeconomic forecasters have a poor record in predicting recessions.

I won’t claim to be any better, I’ve predicted 10 of the last 2 recessions.

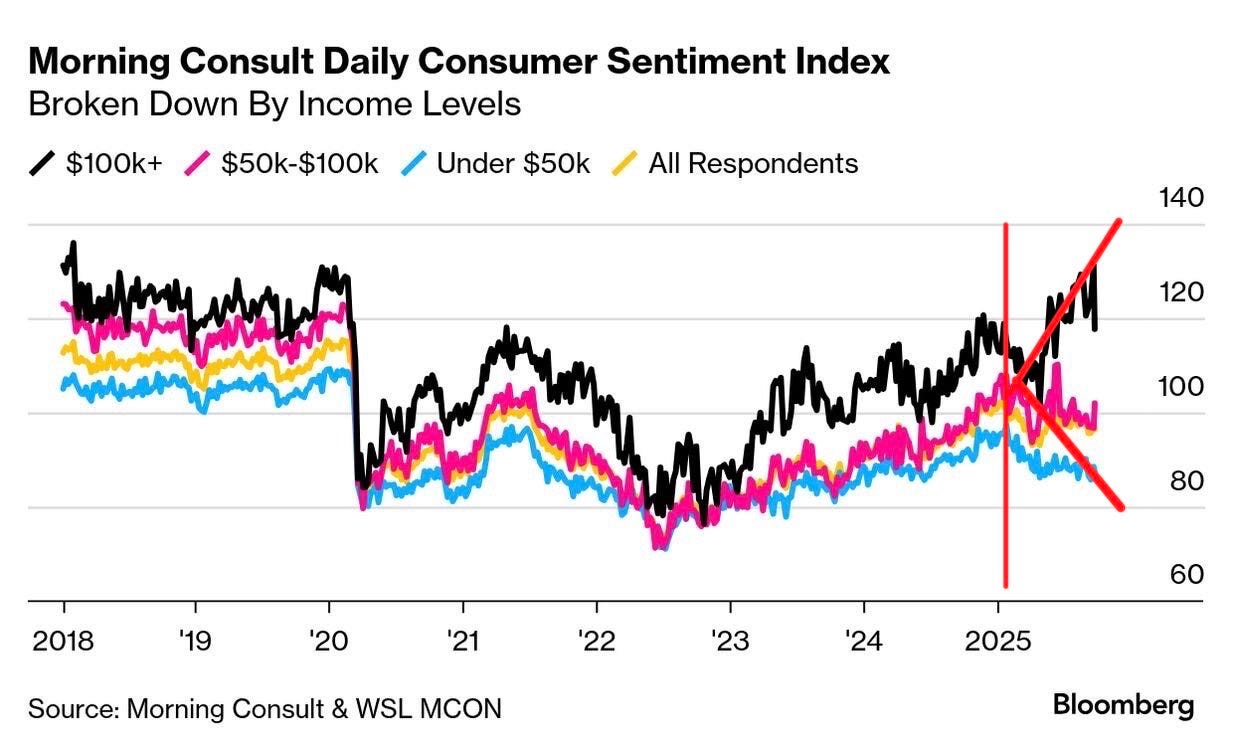

However, right now the data is showing a clear and widening split in how different groups experience the economy. Some are thriving while others are barely holding on. This is not healthy nor a sign of a thriving economy, this is what’s known as a K-shaped economy.

Look, I’m all in favor of the affluent finally getting the respect they so richly deserve but when this has happened before, it rarely ended well. Recent examples include the Post-2008 Great Financial Crisis and the Post-Covid Zero Interest Rate Period (ZIRP) from 2020-2022. The ensuing government response in both cases was to slash interest rates and pump plenty of money into the system. This was great for asset holders (the rich) but the ensuing inflation was very bad for everyone but especially those with less.

We are currently on a similar path, which should concern everyone. This article will explain what is a K-shaped economy, how it develops, when has it happened before and its ramifications.

Keep reading if you want to what a K-shaped economy might mean for you and your loved ones!

But first, make sure to hit the Subscribe button to join 1,000+ other Subscribers that get Serviceable Insights delivered directly to their inbox each week.

If this week’s article does not interest you, please check out some other recent ones:

What is a K-Shaped Economy?

A K-shaped economy describes when there is a substantial gap in how different groups of people or sectors perceive or perform financially. The “K” shape comes from the different plots on a graph: one rising upward (those benefiting) and one sloping downward (those worse off).

This indicates growing fragility because economies are interconnected, weakness will eventually spread which harms healthy parts of the economy at a more rapid and greater magnitude than healthy economies can save struggling parts. As an economy becomes increasingly reliant on a small handful of industries or consumer groups for growth, the less robust it becomes. This is what’s currently happening right now.

Higher-income households ($100k+) are feeling increasingly optimistic (black line rising), while lower-income households (<$50k) show worsening sentiment (blue line declining).

Meanwhile, the stock market is increasingly concentrated on technology and artificial intelligence. We covered in last week’s article The 3 Biggest Lies in Investing how the “Magnificent 7” (NVIDIA, Microsoft, Tesla, META, Alphabet, Apple & Amazon) now represent more than 30% of the S&P 500 market cap and forward earnings growth. Does that feel diversified or safe to you? How did this happen?

What Causes a K-Shaped Economy?

A K-shaped split happens when an economic shock or government policy disproportionately benefits some groups while harming others.

Imagine your town’s entire economy is built on exporting Hawaiian pizza. Then one day, Taylor Swift declares pineapple on pizza disgusting, and suddenly demand collapses. Your town suffers, while the rival city of Pepperoniopolis booms.

The government steps in with subsidies and loans to keep Hawaiian Pizza Town afloat. To entice people to buy your pizza you slash prices in half, Pepperoniopolis needs to respond in a similar way. This sudden pizza war drives up the price of raw materials like cheese and dough making the suppliers a fortune, while both towns get squeezed from the higher costs on one side, lower prices on the other.

The suppliers are buying table service in Ibiza while the pizza competition drives one town out of business leading to mass unemployment. Their lost spending starts to hurt other industries, until a full blown recession is underway.

The government following Keynesian economics and non-sensical Modern Monetary Theory (MMT) respond by higher spending, cutting interest rates and printing money to inject more liquidity in the system until spending levels stabilize.

This helps stop the bleeding but the ensuing stock market rally and lower borrowing costs disproportionally help industries sensitive to interest rates: Real Estate, early stage technology, commodities etc. Suddenly startup CEOs are dating Kardashians and getting facetime with prominent politicians while people in industries with stagnant wage growth are struggling to make ends meet.

This leads to increased polarization between haves and have nots, leading to a thirst for political change, but not moderate change. They want extreme nationalism or socialism but hopefully not both at the same time.

Does any of this sound familiar?

When has this happened before?

K-shaped economies aren’t new. Whenever shocks, policy choices, or structural imbalances tilt the playing field, the result eventually causes some groups to thrive while others sink. Some recent and historical examples exemplify this:

Post–COVID Recovery (2020–2022):

Unless you were born after 2023, you just lived through this. The pandemic’s aftermath saw tech stocks and crypto soar while housing prices broke records. White-collar workers were logging into Zoom in their underwear while low-wage service workers faced layoffs, delayed rehiring, and wage pressure that lagged inflation. The government’s firehose of stimmy checks and zero-rate policies pushed asset prices predictably euphoric levels. Once inflation reared its head, those without assets paid the steepest price. Politicians and central bankers continued to tell us inflation would be transitory while every day people were struggling to pay their bills. This had some influence in President Trump’s re-election, and his administrations embracement of nationalist policies upending the established world order of globalization via tariffs and anti-immigration policies.

Post–2008 Global Financial Crisis:

Like during the pandemic, Hank Paulson, Timothy Geithner, Ben Bernanke, Mario Draghi and others were resolute in their belief the only way to rescue the financial system was for extreme quantitative easing (QE) and near-zero interest rates. The economy did recover, although very slowly but eventually there was a massive run-up in asset prices that rewarded capital owners while leaving many families behind. Millions lost homes to foreclosure. Wage growth stagnated. Graduates entering the job market in the early post GFC years took a big hit to their earnings potential. The stock market embarked on one of the longest bull runs in history, widening the wealth gap and resulting in greater political polarization. This played a role in the electorate embracing political outsiders such as then Nominee Trump and Bernie Sanders.

The Gilded Age / Industrial Revolution (late 19th century):

An often cited example by inequality skeptics. While industrialists and financiers accumulated extraordinary fortunes, agricultural and factory workers labored in increasingly harsh conditions with no real protections. No five day work week, regulated hours. Pretty much you had to just be grateful for the job. Kind of like investment banking but without the glamorous pay or expensable Uber Eats.

There was a great period of expansion but the economic growth was uneven and eventually culminated into labor unrest, violent strikes, and the Progressive Era reforms: antitrust laws, income taxes, and the introduction of labor rights.

I am not saying all of these are necessarily bad things but in all of these cases, the K-shaped growth persisted for a while, until the economy crashed or the have nots revolted leading to massive change.

Does it always lead to recession or political change?:

No. Like most things in economics, a K-shaped economy does not always result in a recession or political upheaval. It’s happened a few times where the split could persist for years without triggering an immediate crisis.

Examples include the United States after World War II, several Asian economies in the 1980s and 1990s, and the mid-to-late 1980s in the U.S. In these cases, growth was strong and persistent enough to cover for weakness elsewhere. The crucial factor is persistence. If growth is broad and sustainable, it can eventually lift lagging sectors.

The danger comes when growth is manufactured through government stimulus, loose monetary policy, or aggressive fiscal expansion. These measures can prop up the system in the short run but often create bubbles that form the basis for the next downturn. (We discussed this in detail in Nobody Understands Interest Rates).

This is essentially what happened after the dot-com bust. The government’s response shortened the recession, but the flood of cheap credit set the stage for the far larger mortgage crisis a few years later.

For a K-shaped economy to endure without unraveling, three conditions need to hold:

The underlying growth must be sustainable

The benefits must eventually reach the underperforming parts of the economy

Policymakers must resist the temptation to overstimulate

Hitting all three conditions at once is rare, which is why K-shaped economies so often end in recession or political unrest.

Conclusion.

Right now we are in a K-shaped economy. This is usually not a good sign for future economic or political prospects. In the short term, it’s great to be rich. They are euphoric, which is why they are spending $17M on Honey Deuces at the US Open. Meanwhile many Americans are falling behind on their mortgages and accumulating billions in credit card debt.

The stock market is being propped up by AI hype and expectations of lower interest rates. That mix suggests today’s K-shape is unlikely to be sustainable. Weakness will eventually spread into other parts of the economy, forcing the Federal Reserve to walk a narrow path if it wants to stabilize growth without sparking another crisis.

If the economy avoids recession, those with assets and those positioned to benefit from AI will likely continue to thrive. Everyone else will face growing challenges. That divergence almost always brings political consequences, either through aggressive government intervention or the public demanding it.

Of course, nobody can confidently predict what the economy will look like 12 to 18 months from now. Maybe everything will work out fine. Book that trip to Japan. Buy more crypto. Keep reading Serviceable Insights.

Thank you for reading. If you liked this article please Subscribe below. I publish articles on a wide range of topics from business, books, current events or anything on my mind.

If you want to learn more, Ray Dalio has spoken extensively on this topic.

The split is real, but cycles always end the same way — the top can’t outrun the bottom forever. For investors, it’s less about predicting the exact downturn and more about asking: “If this cracks, does my portfolio still cash flow?”

Hope it's K for kinetic and not kaput! 🙏