Why Does Literally Everyone Hate Banks?

Is their business model set up that way?

Consumers hate banks. Politicians hate banks. Lenders hate banks. Borrowers hate banks. Even banks hate banks. Why?

Is it because they always have lines? In any country, at any time of day, I guarantee you, walk into a bank and you’ll be waiting.

While you’re waiting you might glance over and wonder why they keep their pens chained to a desk? Who are they trying to prevent from stealing them? They must realize there’s a vault full of cash back there. I’m something of an expert on bank robbing, and I can tell you, thief’s aren’t there for the pens.

In any case, little things like this annoy people. If that’s not their gripe, then maybe it has something to do with the belief they caused a major economic collapse due to aggressive lending practices leading up to 2008? Also in 1873, 1907, 1929, 1990, anyway you get the point.

What if this isn’t entirely their fault? Their business model, along with regulatory and monetary policy pressure puts them in a situation that will make them villains.

In 2025, perhaps they are the real victims. They face severe headwinds from regulations and competition while interest rates, remain low.

Today’s article will give an overview of the traditional bank business model, regulatory changes post 2008, and how fintech & crypto are disrupting the party.

Keep reading if you want to be better informed while you hate on banks!

But first, make sure to hit the Subscribe button below to be the 1,000th Subscriber to Serviceable Insights to get articles like these, delivered directly to their inbox.

week’s article does not interest you, please check out some other recent ones:

Traditional Bank Business Model Explained

You are probably familiar with the basic principle of banking. You deposit your money, they pay you some interest to hold on to it, they lend out this money at a higher rate. Sounds simple enough right?

As an inquisitive mind, you might have more questions such as:

How do they determine how much interest to pay you?

How do they decide how much to lend and at what price?

Why am I earning 0.1% from my savings account but the fed funds rate is 4%?

I answered some of these questions in my recent article Nobody Understands Interest Rates but basically banks earn money by receiving a higher rate of interest than what they pay to their customers who deposit their money with them. This difference is called the net interest margin and banks earn this by:

a) Lending for longer maturities, at higher interest rates. This can include mortgages, auto loans, business term loans or even credit cards and lines of credit.

b) Parking idle deposits with their central bank to earn a spread between the current overnight/policy rate and what they need to pay depositors

Since you can withdraw your money at any time, banks need to treat your deposits as if you are making them a short term loan. As such, they need to maintain enough liquidity on hand for customer redemptions, while lending enough to turn a profit.

Lending is risky though. Borrower’s sometimes default on their loans. If a bank lends at a fixed rate but interest rates go up, the current value of their loan books drop. If they take on too much risk, at the wrong price, things can get dicey fast. To mitigate this, they hire a lot of people who in theory, understand how to underwrite these risks. Since government’s don’t like when banks go under or finance unsavory things, there are a lot of regulations they need to follow, so they need a lot of compliance folks too.

If they don’t make enough loans, they won’t be able to pay for all these risk experts, compliance folks and other people who work at the bank. Not to mention the branches and fancy offices. Sometimes they can get away with writing fewer loans and earning easy money while central bank policy rates are high, but this is usually accompanied by fierce competition for deposits, increasing the rate of interest they need to offer clients.

However, when interest rates are low, not only is it hard for them to earn money by arbitraging rates from the central bank, they are earning less interest on new loans, which forces them to make money elsewhere. Either they need to earn a higher yield by taking on more risk, or find new ways to charge clients fees. Rates have been historically really low for the past two decades, which is why retail banks give you very little interest and charge for everything.

After the repeal of the Glass–Steagall act in 1999, American retail and commercial banks began merging, swelling the size of bank balance sheets, permitting them to take on greater risk exposure. They did exactly that, trusting their very accurate risk models, that worked extremely well looking back in time. Small problem. They worked less well looking forward.

Post 2008, banks had to deal with even more regulations, which not only forced them to hire even more compliance folks, but also limited what they could charge. An example of this is the Durbin Amendment that capped the rate banks with >$10 Billion in assets, can charge on interchange (the network fee credit card companies charge to merchants for accepting payments). Effectively smaller banks can earn nearly twice as much per transaction. While this might not have been the intention, this opened the door for alternatives to the traditional banking model.

Fintech Companies: Not Just for Broke Millennials

"There are only two ways to make money in business: bundling and unbundling" — Jim Barksdale, former CEO of Netscape.

The Problem: Banking Doesn’t Work For Everyone

The traditional bank model wants to acquire a customer, by getting them to open a bank account, then gradually adopt other products and services over time. Since bank offerings are pretty much undifferentiated and switching is tedious, customers rarely change. So unless you’ve moved cities or countries, you’ve probably been with the same bank your whole life. The longer a customer sticks around, the better the unit economics for the business. In the case of banking, unit economics are very good.

This is why they can justify all kinds of promotions to entice us to deposit money. It used to be a toaster, nowadays it can be anything from golf clubs to air pods. Anything they think millennials or Gen Z like. Why shouldn’t they give you something worth a couple hundred dollars to earn thousands of dollars per year for decades?

As you might have surmised, wealthier customers generate more revenue. They have higher deposits, can spend more and need services like wealth management, investment brokering, foreign exchange etc. Banks will happily lend to these kinds of customers because they don’t need the money, so they are less likely to default.

This is not to say they won’t take money from less wealthy customers too, they will take all the deposits they can get. However, to make up for the lower revenue, they start layering in additional fees. Want us to hold your money for you? $10 per month. Want to send a wire? $15. Need to convert USD to Pesos? Here’s a 10% haircut.

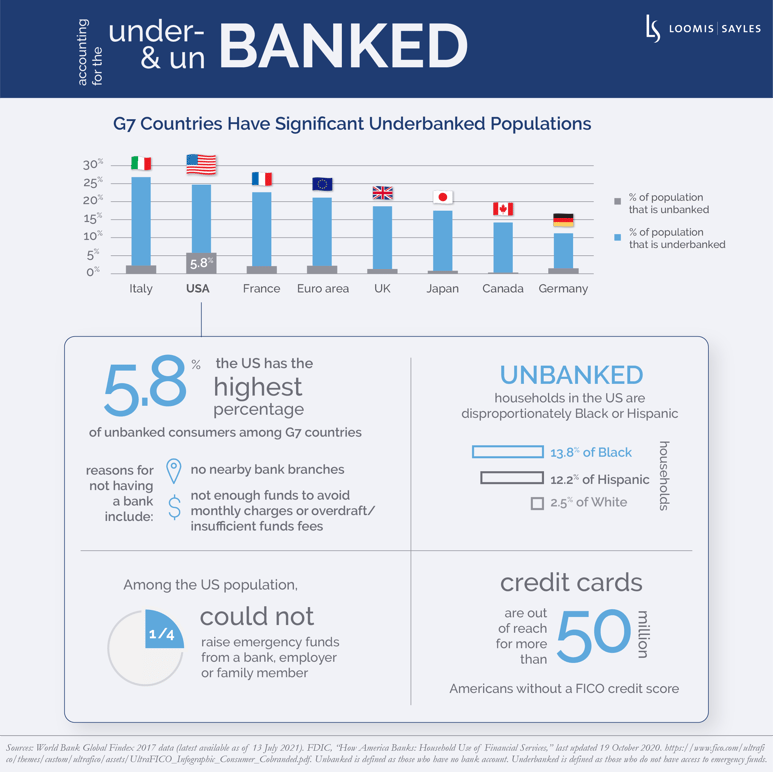

These fees can get frustrating, and make banking inaccessible for people with very low income or savings. Especially in the cases where the bank doesn’t want to extend them credit owing to their poor credit score or non-existent history/recurring income. This segment is considerable. In developed countries alone, there are tens of millions of people unable to open a bank account, and many more are underserved.

The Solution: Regulatory Arbitrage & Unbundling

“Your margin is my opportunity” — Jeff Bezos

You know somebody would come for these underserved customers. Traditional banks are forced to make money a certain way because of their large operating overhang that comes with having a banking license, legacy bank branches and a technology stack nearing retirement age. What if you were starting a company from scratch and decided you didn’t need to be everything to everyone?

After the Great Financial Crises, many fintech startups emerged seeking to fill the gaps within financial services industry. The widespread adoption of smartphones, a generation more comfortable managing money virtually and new regulations created an opportunity for innovation in a sector that had not changed much in decades. Instead of getting a bank charter, fintech companies realized there was a quicker and easier way to provide customers access to financial services. Revolut, TransferWise, Monzo and Chime, approached things differently, but all decided to focus on one specific product, tailored to a narrow segment.

Whether it was cards with low FX rates or fee-free checking accounts, these companies unbundled. They could do this because they offered products that seemed similar to the customer, but in the backend functioned differently. Since Revolut and TransferWise issued pre-funded debit cards, they weren’t taking credit risk. They still needed to worry about fraud, anti-money laundering (AML), Know Your Customer (KYC) and other matters but by focusing on a slim niche, coupled with a modern tech stack, they could serve more clients with fewer people than the traditional banks.

These fintech companies were willing to cede margin on FX or account fees, because they could instead earn money on interchange; at a higher rate compared to the large banks. By partnering with small community banks and venture capital backing, they could sustain losses for the medium term, as they acquired customers and expanded their product offering, to increasingly replace other bank functions.

(Check out ‘s great breakdown of Chime’s S1 a few months back)

Since most banks are publicly traded and slower growing, investors put a large emphasis on profitability, which prevents them from burning millions of dollars for years as they attempt to land customers. For banks to compete with nimble upstart neobanks, they need to simultaneously build the new plane while flying the old one. Banks do not have the luxury of “Move Fast and Break Things”. Consumers need to be able to access their money at any time. Regulators will come down on banks harshly if they can’t ensure this. If their customers have concerns about their stability, it doesn’t take much to cause a bank run.

A bank run occurs when a large number of a bank's customers withdraw their deposits simultaneously due to concerns about the bank's financial stability. This happens because people fear the bank might be unable to repay its debts, leading to a loss of confidence and a rush to withdraw funds. Ironically, this mass withdrawal can actually cause the bank to fail, as banks typically hold only a fraction of their deposits in reserve.

We saw this recently with Silicon Valley Bank, which was highly concentrated to technology startups and venture capital firms. As concerns started to circulate about their lack of liquidity, firms began pulling their deposits rendering the bank insolvent.

Most fintech companies only get a bank charter once they’ve reached sufficient scale in their original products, allowing them to operate with less oversight until then. They get to pick off lucrative product lines from banks, without the same compliance requirements. The more this happens, the more bank customers wonder why they need to put up with clunky mobile banking apps when Robinhood is giving them fancy gold credit cards (and selling their trading data to hedge funds but they don’t like to talk about that).

(Robinhood CEO Vlad Tenev, Reddit CEO Steve Huffman, Citadel CEO Ken Griffin and Online Trader Keith Patrick Gill known as “Roaring Kitty” being questioned by congress after the GameStop Saga )

The Future: Adapt or Die

In 2025, banks are between a rock and a hard place. They face intense competition from fintech companies unbundling every aspect of financial services. Whether it’s neobanks offering better savings or cashback rates, stablecoins reducing FX fees or digital first brokerages offering a better user experience, the old bundle formula is not enough to retain customers.

Banks can’t change the fact they are heavily regulated and the focus of intense scrutiny. They play too important a role in the economy and society. Their legacy tech stacks and bloated cost structures are a hinderance. Despite this, they have a massive advantage hold virtually all the deposits, so they hold all of the cards. People would much rather stay, then leave and it’s cheaper to retain existing customers, instead of acquiring new ones. These fintech’s despite their advantages, have to pay a lot to get people to leave behind their existing providers.

If the legacy banks can zero in on what the modern financial services user needs, they can adapt their offering to provide an updated bundle worth sticking around for. Financial services is a commodity, so they don’t need to be first, they just need to be good enough, so people don’t hate them.

Thank you for reading. If you liked this article please Subscribe below. Each week I publish an article on a wide range of topics from business, books, current events or anything on my mind.

Nice piece, Ben!

It's hard to understate the degree to which digital-only fintech companies have made banking far more competitive and consumer-friendly.

FX fees used to be a big source of revenue for credit card issuers. Now, there are plenty of cards with no annual fee offering 0% FX fees and 2%+ cash back. Basically, fintechs are giving up the majority of their interchange revenue in the hopes of making money off interest.