Revisiting Peter Thiel's Zero to One: 10 Years Later Part I

Revisiting Chapters 1-3. Tech vs Globalization, Incremental Advances vs Boldness & Monopoly Businesses

Among Venture Capitalists and Tech Entrepreneurs, Peter Thiel requires no introduction. He founded PayPal, Palantir, Founders Fund and a few other investment firms, was the one of the first investors in Facebook and established the Thiel Fellowship, which offers select enterprising high school graduates $100,000 to build a startup instead of enrolling in college1. In 2012, while lecturing at Stanford, one of the students in the class, Blake Masters2, took such extensive notes, that they would become the book Zero to One: Notes on Startups or How to Build the Future.

Zero to One is regularly listed as one of the best books ever written on Startups, business and technology. It was well received upon its release and ten years later, it remains as relevant and prescient. Not only do most of the lessons remain true, Thiel’s own prominence has dramatically risen. When Zero to One came out in 2014, beyond a thinly veiled caricature on the TV Show Silicon Valley3, few people knew him outside of technology circles. Two years later, he spoke at the Republican National Convention. Never afraid of being contrarian or controversial, regardless of how people feel about his political views, most would agree that he is among the most influential people to emerge from the Valley in the past 20 years.

With the benefit of a decade of hindsight, I decided to revisit the book to evaluate how much of Thiel’s views and predictions would be considered true in 2024. For this series, I go through each chapter to determine if I think he is still right today.

Today I will be evaluating Chapters 1-3 and will cover the remaining chapters in subsequent posts.

Chapter 1: The Challenge of the Future

“This age of globalization has made it easy to imagine that the decades ahead will bring more convergence and more sameness… the division of the world into the so-called developed and developing nations implies that the “developed” world has already achieved the achievable, and that poorer nations just need to catch up. But I don’t think that’s true. My own answer to the contrarian question1 is that most people think the future of the world will be defined by globalization, but the truth is that technology matters more. Spreading old ways to create wealth around the world will result in devastation not riches. In a world of scarce resources, globalization without new technology is unsustainable.”

1 The contrarian question is “What important truth do very few people agree with you on?”

Hold on, let me ask Chat GPT. Did technology or globalization have a bigger economic impact since 2014? Shockingly, Open AI’s Large Language Model seems to think it was technology. This might seem obvious today but at the time Zero to One was published, it was not as clear.

In 1998, Nobel Peace Prize Winning Economist Paul Krugman was skeptical of the promise that technology would represent for the economy. Famously writing "By 2005 or so, it will become clear that the Internet's impact on the economy has been no greater than the fax machine's." Even by 2012, when Thiel was lecturing at Stanford, forming the basis of what later became Zero to One, technology's impact on the economy was already heavily noticeable although not to extent that it is today.

Globalization measures the increasing free flow of goods and services, which would include technology. To isolate technology from globalization, let’s evaluate its impact based on the growth in IT relative to other sectors in addition to its increasing relevance within the US and global economies. At the time, global IT spending made up 5% of global GDP and Apple, Microsoft and Google were consistently among the 10 most valuable companies in the world.

Since 2012, while IT spending has grown, it still makes up about the same percentage of Global GDP4 however, now tech companies comprise 7 out of the 10 most valuable firms5.

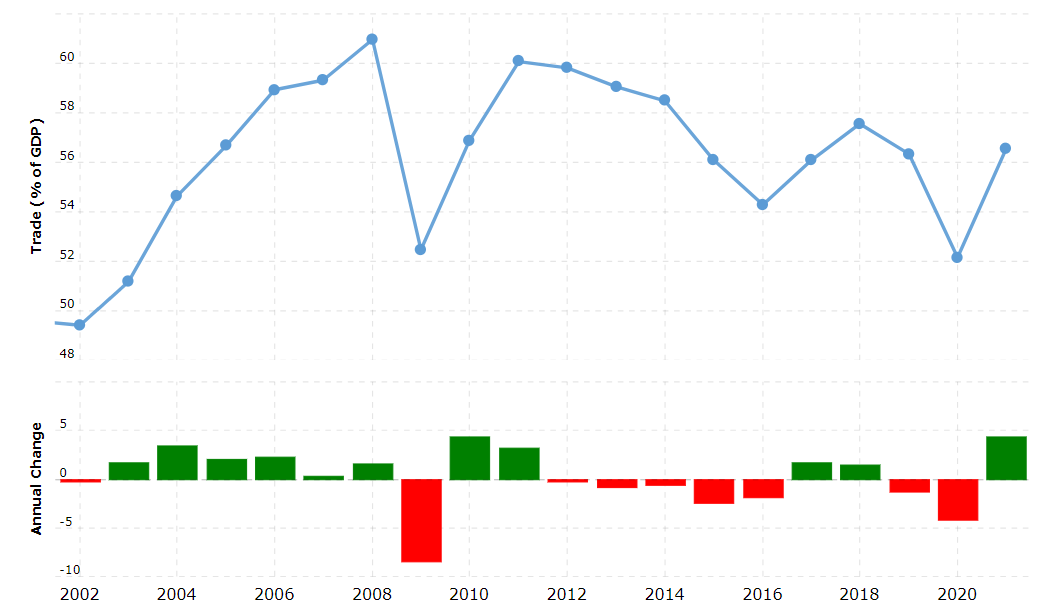

There is conflicting data when it comes to international trade but at least by Global Trade to GDP ratio, it has actually declined since its 2011 peak. Therefore, even though global trade has increased, it makes up a smaller percentage of GDP. Meanwhile, relations between countries have certainly frayed and this is negatively impacting primary beneficiaries of globalization, such as China.

(This Chart shows Global Trade as a % of GDP as per the World Bank )

Ray Dalio in his March post on China had two passages that more or less make Thiel’s case, that technology is more impactful than globalization:

1) “The Chinese economic model is based on gaining an increasing share of world manufacturing output, which has a good chance of not happening because countries that in the past have imported Chinese goods are more likely to prevent them with rising tariffs.”

This passage is not consistent with increased Globalization. Dalio in his piece mentioned that the US-China Trade war was one of the main factors setting China up for a 100 year storm. Although Trump gained most of the headlines for his bold actions during his Presidential term, both major American parties have embraced protectionist measures against China over the past decade.

2) “While technology development has always been a critical defining force and while it is well known that whoever wins the technology war wins the economic, geopolitical, and military wars, this has never been truer than now, and China and the US are the leaders and big adversaries.”

In 2024, the main headlines concerning the US and China are no longer about cheap goods, but ByteDance, a Chinese Social Media platform and Semiconductor chips in Taiwan. Semiconductor chips could put the US and China on a potential collision course for increased hostilities and maybe even armed conflict over the next decade.

During the Global Pandemic, the importance of technology was on display. If not for Videoconferencing, Cloud Storage and other innovations, we could only imagine how hazardous it would have been for the Global economy. The Pandemic also exposed the fragility of supply chains and some of the downsides concerning Globalization while technology proved to be antifragile.

Conclusion: Thiel so far has been right, that Technology is more relevant than Globalization.

Chapter 2: Party Like IT’S 1999

“The entrepreneurs who stuck with Silicon Valley learned four 2 big lessons from the dot-com crash that still guide business thinking today”:

Make incremental advances

Anyone who claims to be able to do something great is suspect, (be more humble). Small incremental steps are the only safe path forward.

Improve on the competition

Don’t try to create a new market prematurely. The only way to know if you have a real business is to start with an already existing customer, so you should build by improving on recognizable products already offered by more successful competitors.

These lessons have become dogma in the startup world and yet the opposite principles are probably more correct.

It is better to risk boldness than triviality

Competitive markets destroy profits (See Chapter 3)

Is it better to risk boldness than triviality?

If your goal is to own a small share of a massive market, incremental advances might be fine. However if you are choosing to merely improve upon something that already exists, you are by definition setting yourself up for competition. This competition will at best slow down your growth, assuming you are able to maintain this advantage. You can benefit from first mover advantage but if you want to capture maximal value, you are ideally not directly competing with anybody. Some recent examples come to mind:

Deel became one of the fastest growing companies in recent memory when they enabled companies to quickly hire remote, global talent as if they were full time equivalents (FTEs)6. If they set out with the goal of building a better Workday, they would not have been able to hit $100M in just over one year and $400M in ARR, 4 years after launch. Deel recognized that there was a clear void in the market for hiring international talent and set out to build something unique. This is not something that was being attempted by anyone else and although there appears to be questions about the legality of some of their maneuvers, what Deel did was certainly bold and made hiring international talent much easier. As a point of comparison, it took Rippling 8 years to reach $300M in ARR. Rippling is a great business, but it is definitely more of an improvement over existing vendors such as Workday, which is why their growth is much more consistent with a top performing SaaS company, and not the astronomical vertical X growth of Deel7.

Open AI has quickly become the most hyped AI company in the world. While not the only Large Language Model, the public launch of Chat GPT certainly kicked off the most recent AI hype wave. Open AI reached the $2B in revenue figure just a few months ago and expects to be able to more than double this in 2025. For a company that only began to sell a few years ago, that is astronomical growth. If Open AI had released a slightly enhanced version of Alpha Fold or Boston Dynamics, they wouldn’t be the household name they are today. All of the other AI models trying to chase them, are going to face the tall task of trying to compete for relevance as normally the first mover will command most of the attention.

Until a competitor can emerge that demonstrates their technology is such a massive improvement over the incumbent, that there is no reason to consider the alternatives. Open AI has this massive advantage. While Open AI & Deel have first mover advantage, it is merely an advantage. To capture long term value from their respective markets, they need to prove that they can be the last company in their category (See Chapter 5). Based on the examples provided, we can evaluate Thiel’s claim as True, since small incremental improvements are not the only safe path forward.

Chapter 3: ALL HAPPY COMPANIES ARE DIFFERENT

“All happy companies are different: each one earns a monopoly by solving a unique problem. All failed companies are the same: they failed to escape competition.”

&

“Only Monopolies have the luxury of long term thinking because of their excess profits. This does allow them to launch new and exciting business lines.”.

One of the key ideas from Zero to One, is the notion that companies should aim for a monopoly. He cited basic economics, contending that the more competitive the market, the less profits there will be available, since more entrants will join and compete those excess profits away. This was explained famously by Jeff Bezos “Your margin is my opportunity”. Do the 5 largest public companies have a monopoly? Let’s define a Monopoly as owning >50% market share in at least one vertical.

Top 5 Companies

Microsoft - Above 50% market share in a few key segments (operating system (PC), Microsoft Office) definitely a Monopoly.

Apple - Above 50% market share in the US smartphone market (a monopoly) and a few other key segments such as their App store. Monopoly.

NVIDIA - For the time being, very hard to argue they do not have a Monopoly over the GPU market.

Saudi Aramco - Not a Monopoly but 10% of global oil supply is still massive.

Alphabet - They have a Monopoly on Search, and own market share in a few other key segments.

This would confirm Thiel’s claim in Zero to One; the most valuable companies (the happiest) solve a unique problem.

We can also include a few other companies in this category such as Facebook (Social Media) and Amazon (not a Monopoly but dominant share in a few key categories). To maintain a long term technology monopoly, companies must constantly innovate and demonstrate to consumers that they have the strongest offering. In the last 10 years, Big Tech has certainly launched new products to the consumers benefit, however when we look at each of the big tech monopoly businesses, we see that many of these innovations look more like product enhancements to existing products instead of new innovations and when they do innovate, it appears to come from copying the competition or from M&A activity. Don’t believe me? Let’s go company by company:

Microsoft:

How has Microsoft’s product suite changed since 2014?

Beyond improvements to Microsoft Office Suite, Azure and PC operating system, they have further enhanced their video game portfolio, the most prominent move coming with the Minecraft acquisition & the Activision deal. They acquired Github in 2018, which represents a powerful business product extension targeted for developers, especially now that they can enable Auto-pilot capabilities.

This is likely why they made the genius decision to quasi acquire Open AI. With this one move, they leapfrogged Google and can now reap the benefits of the most recent AI revolution. Beyond these great acquisitions, I can’t think of any examples of an internally developed new technology representing a meaningful new innovation for Microsoft since 2014 (sorry Balmer).

Apple:

Apple, one of the most innovative companies in the history of the world and the house that Steve Jobs built. What have they brought us since 2014?

Outside improvements to their iPhones, Macbooks and iPads, they launched the Apple Watch in 2015, the AirPods in 2016, Apple TV+ in 2019 and the Vision Pros in 2024. While all of these products contribute Billions in revenue to Apple each year, none have represented the paradigm shifts that Apple were known for under Steve Jobs. Apple has done the best at commercializing their new innovations out of this group, but their new products are pretty closely related to what they were offering 10 years ago. Their attempts at a driverless car, went nowhere. Apple TV+ is engaged in intense competition, and not even in the top 5 amongst streaming platforms. Right now the Vision Pros are the most likely product that could prove me wrong.

Amazon:

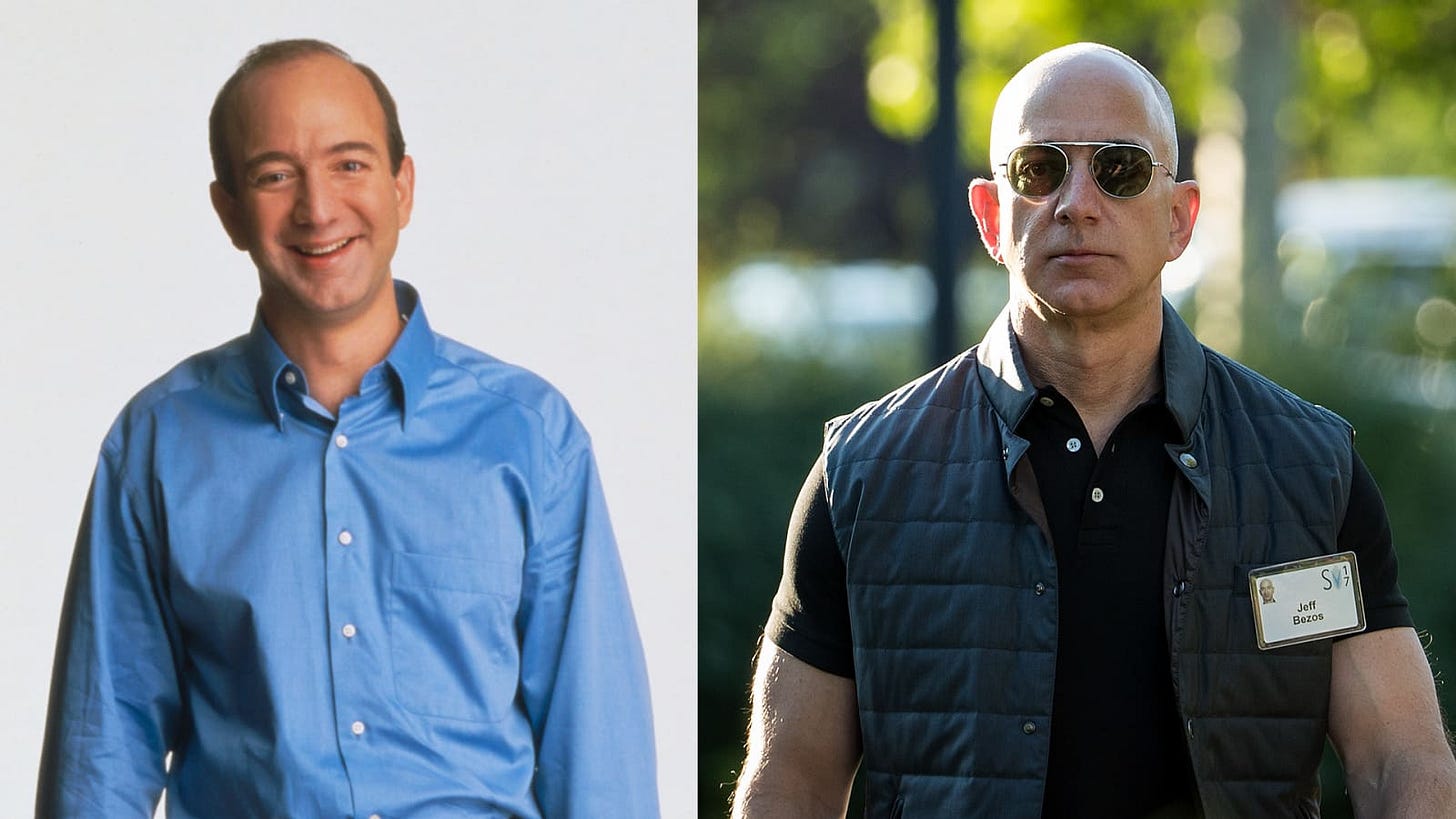

Amazon pioneered e-commerce and Cloud Hosting, launched Kindle readers, and forced retailers into guaranteeing 2 day delivery through Amazon prime. However since 2014, it is harder to point to new product launches that have thus far created a similar effect. They made a great acquisition of Twitch but otherwise, Amazon Music, Prime Video and Echo/Alexa represent improvements or copies from existing businesses. In the case of Alexa, it just did not live up to the hype. If I was writing this, 4 years ago, it would seem that Amazon was poised to take over. They were firing on all cylinders, looking to move into Gaming, Healthcare and more verticals. Outside of the continued AWS dominance, Bezos transitioned to Chairman to compete with Elon on Space full time, they shut down Amazon Care and Smart Home initiatives, they are walking back their no touch checkout and their Lord of the Rings TV series fucking sucked. At least over that span Bezos did get jacked and embrace his villain arc. (They also made a smart investment in Anthropic)

Alphabet:

The last Search company, owners of Android and Youtube, not to mention one of the most influential mafias rivaling Thiel’s PayPal disciples. They have made major improvements to all their products since 2014, and they are not afraid to take big swings. From their post 2014 products, Waymo (autonomous vehicles) has not lived up to their commercial aspirations but is unquestionably an innovative product. Google Suite has emerged as a viable threat to Microsoft Office Suite8 and their acquisition of DeepMind scared the rest of Silicon Valley into creating Open AI.

While Alphabet gets a lot of praise for their willingness to experiment and work on innovation, few of these cool things that Alphabet has worked on over the past decade, have turned into meaningful revenue generators. In 2014 Search represented 90% of their revenue, they have successfully diversified so that it only represents closer to 50%, but that growth came from Youtube, G-Suite and Cloud. These are all great product lines but they acquired Youtube nearly two decades ago, and while the product has improved substantially, it is still roughly the same model. G-Suite and Cloud were Google’s responses to Microsoft Office and AWS. Everybody expected Google to dominate AI but Bard ended up being a huge flop, which pierced Google’s mystic image. Google is definitely an innovator but their ability to commercialize these new innovations needs to be reaffirmed.

Facebook:

Since 2014, Facebook’s Corporate Development team have successfully acquired and integrated Instagram, WhatsApp & Oculus to the extent that some would argue they are more valuable than the original product. If not for Google’s acquisition of Youtube, I would be prepared to call the Facebook acquisition of Instagram, the greatest of the Consumer Web 2.0 generation. The dominance of these acquisitions is evidenced by the many attempts of politicians to undo them, years after the fact. While they have naturally made major enhancements to all of these platforms since acquiring them, with the size, scale and talent available at Facebook, if Thiel’s contention is correct, why did they have to acquire these much smaller startups for Billions, instead of developing it internally?

If you look at Facebook today, they have made Instagram, What’sApp and Oculus core to their product roadmap, with most of their new developments coming through these platforms. Many of Facebook’s other initiatives such as Diem/Libra (Crypto platform) & Lasso (Tik Tok Competitor) never took off. Their latest new platform release, Threads (Twitter Competitor), was the fastest app to reach 100M users (5 days), yet growth quickly stalled after a few months, and with it being less than one year since it’s launch, it’s still too early to call if it can reach a similar scale to the other Facebook platforms or if it only exist to be a temporary heel to X (formerly Twitter). Outside of their Metaverse initiatives, their social strategy for the past few years has appeared to be a watch and copy approach9.

This appears to be consistent with what the rest of the Big Tech Monopolists have reverted to10. Thiel was right that all happy companies are different because they earn a Monopoly. These companies were all Monopolies when he wrote Zero to One and they are still Monopolies today. However, despite these excess profits, their innovation efforts have all somewhat underwhelmed over the past 5 years. I will discuss why I think that is the case in Chapters 4 & 5 summaries in the next post.

Some notable Thiel Fellows include Ethereum co-creator Vitalik Buterin, Dylan Field co-founder & CEO of Figma, Austin Russel founder of Luminar Technologies, Taylor Wilson the second youngest person to achieve nuclear fusion and many others.

Republican Arizona Senate Nominee in 2022 now running for Arizona’s 8th congressional districts in the House of Representatives in 2024

See Peter Gregory

Global IT spending was $3.8 Trillion (5% of Global GDP) in 2012. By 2023 it grew to $4.6T but still only makes up ~5% of GDP.

Apple, Microsoft, Alphabet, NVIDIA, Amazon, META & Tesla

Deel is incorporated in almost every country, which permits them to hire local employees, with the same rights and protections as a local company. When a Deel customer wants to hire an employee in that country, the new hire becomes an employee for Deel Country X, then the Deel customer pays Deel through their platform.

Deel has grown very quickly but does not replace existing HRIS system and the cost is very high (~$500 per month per FTE), therefore customers are heavily incentivized to find lower cost alternatives or just incorporate within a country once they have enough FTEs. The key question will be if Deel can build out their product offering sufficiently to incentivize long term relationships with their customers, consistent with other HRIS players in the space. Deel despite the high revenue and valuation, is still a very young company and has to prove they can have enduring staying power.

But why can’t Google Sheets just have the same shortcuts as Excel?

Their LLama model has a decent change of proving me wrong

I did not mention this in the post but META, Google and the other Tech Monopolists are all working on chips to compete with NVIDA. If one of these companies can successfully steal meaningful market share, this would discredit my criticism about their inability to launch new business lines without acquisitions.

Did I read Lucky? One is lucky, but two, three, four etc is not lucky, its strategy and intelligent. Please give proper credence to the legendary investor

What has Thiel even done in the last decade anyway? He just got lucky with Facebook and PayPal