Revisiting Peter Thiel's Zero to One: 10 Years Later Part II

Chapter 4-6. The Ideology of Competition, Last Mover Advantage and Lottery Ticket

Among Venture Capitalists and Tech Entrepreneurs, Peter Thiel requires no introduction. He founded PayPal, Palantir, Founders Fund and a few other investment firms, was the one of the first investors in Facebook and established the Thiel Fellowship, which offers select enterprising high school graduates $100,000 to build a startup instead of enrolling in college. In 2012, while lecturing at Stanford, one of the students in the class, Blake Masters, took such extensive notes, that they would become the book Zero to One: Notes on Startups or How to Build the Future.

Zero to One is regularly listed as one of the best books ever written on Startups, business and technology. It was well received upon its release and ten years later, it remains as relevant and prescient. Not only do most of the lessons remain true, Thiel’s own prominence has dramatically risen. When Zero to One came out in 2014, beyond a thinly veiled caricature on the TV Show Silicon Valley3, few people knew him outside of technology circles. Two years later, he spoke at the Republican National Convention. Never afraid of being contrarian or controversial, regardless of how people feel about his political views, most would agree that he is among the most influential people to emerge from the Valley in the past 20 years.

Welcome to Part Two of my series revisiting Thiel’s Zero to One.

In Part One, I investigated Thiel’s claims around Technology vs Globalization, Boldness over Triviality and Competition.

This post focused on Chapters 4-6, specifically competition & long term value and how repeat successful entrepreneurs negate arguments reducing success with luck.

Chapter 4: THE IDEOLOGY OF THE COMPETITION

“Rivalry causes us to overemphasize old opportunities and slavishly copy what has worked in the past.”

Thiel believed that companies engaged in competition did not have the luxury of innovating; this was something reserved for Monopoly businesses. This runs contrary to conventional Economic theory, that teaches that Monopoly companies stop innovating, while competitive companies need to innovate to survive.

In Part One, I went through the product releases from Apple, Alphabet, Amazon and META since 2014 and demonstrated that almost all of their successful products actually came from acquisitions. Even when they do launch new innovative products, they have a difficult time effectively commercializing them.

What Thiel might have missed in 2014, was that these companies would balloon in size after rapid hiring sprees and become the subject of increased government attention, in part because of several scandals. In the aftermath of the Great Financial Crises, regulators were largely focused on the banking sector allowing technology companies to operate mostly unencumbered. There was a noticeable shift in sentiment at around the time President Trump was elected, that invited scrutiny from both sides of the article. While Social Media platforms such as Facebook and Twitter drew the initial ire, it eventually permeated to the other Tech companies as well.

This new distrust stifled at least a few product launches. Facebook’s crypto play Diem, which seemed promising technologically, could not take off because of a lack of trust amongst the public and Facebook in the wake of Cambridge Analytica. Similarly, Google was working on a Smart City project “Sidewalk Labs” with the city of Toronto. They faced severe criticism for the handling of personal data, which was among the reasons they eventually cancelled the project. These are among many examples of the public and regulators reluctance to trust big tech companies which inhibited their efforts to launch new innovative products.

Gemini Struggles

I believe this contributed to the increased involvement of additional stakeholder groups that made shipping products an increasingly slow and difficult process. Google’s Gemini is a perfect example of this. Despite having what many believed was a massive advantage when it came to Artificial Intelligence, Open AI beat Google to market with the public release of Chat GPT. After capturing the initial hype and praise, Google released their competitor with far less fanfare. Google had been playing catch up the entire time, this was only further exasperated when users started noticing some odd issues with their image generation application.

This image generation difficulties, were largely linked to the involvement of Diversity Equity and Inclusion (DEI) initiatives at the company. Big Tech in general has had to contend with increased political activism from their workforce, which critics point to as a sign that innovation may no longer be there primary driving force. Even when politics are not involved, it appears that the Big Tech Monopolies have struggled launching new product lines. After many years working on Autonomous Vehicles, Apple announced layoffs in this division and wanted to pivot the existing employees to focus on other AI opportunities. Considering, Apple had the opportunity to acquire Tesla only a few years ago, this is a big blow to their reputation as innovators.

As Big Tech has matured, their new model appears to have adapted to allowing smaller companies to take the initial technology or business risk, then rapidly acquire or copy them. Only a few years ago, people joked that Evan Spiegel, CEO of Snapchat, was the Product Manager for the rest of the Social Media companies because of the rate that Instagram, Twitter and Linkedin were copying his Snapchat features. Meanwhile META can monetize their audience at a rate 10X that of Snapchat, so what incentive do they have to beat Snapchat to test these new features1?

On the other end of the spectrum, Tesla while the leader in the electric vehicles, has seen far more entrants join their market over the past 10 years compared to any of the other big tech companies yet they continue to innovate at an incredible rate. They have released the Model X (2015), Model 3 (2017), Model Y (2020) and announced the Cybertruck, not to mention many other software and battery improvements. They went from being the only Electric Vehicle Manufacturer, now every major auto company has one, not to mention many other upstart new entrants. If anything, the competition has inspired Tesla to continually push the envelope and not “slavishly copy what has worked in the past”. All of Elon’s companies are engaged in serious competition yet manage to find ways to innovate.

Therefore Thiel’s perspective on Rivalry forcing companies to fall back on what worked and stopped innovating, should be adjusted to reflect that the lack of competition, can also prevent new products from getting to market, because these companies do not have any direct competitors that pressures their delivery timelines.

Chapter 5: LAST MOVER ADVANTAGE

“If you’re the first entrant into a market, you can capture significant market share while competitors scramble to get started. Moving first is a tactic, not a goal. Being the first mover doesn’t do you any good if someone else comes along and unseats. It’s much better to be the last mover, make a last great development in a specific market to enjoy years or decades of monopoly profits. The way to do that is to dominate a small niche and scale up from there, toward your ambitious long-term vision.”

When Thiel wrote this, he had several recent examples to draw upon. Facebook was not the first digital social network but at the time had completely dominated the landscape, eradicating the incumbents, Myspace and Friendster from relevance2 . Similarly, Google was not the first search company, but within only a few years were rendering >90% of search revenue.

Thiel once again, posits something that runs contrary to what economic theory and business school has taught for the past decades. Instead of trying to build a Monopoly by being first to market, then constantly staying ahead of the competition, all you really need is a defensible innovation that cannot easily be replicated. This does not need to be purely technological, Airbnb and other marketplace businesses have shown incredible staying power by harnessing such a demand and supply advantage over alternatives. VRBO (launched in 1995) and Couchsurfing (2004) were both early to market but were quickly supplanted only a few years after Airbnb’s launch. While not a Monopoly within the context of the entire vacation rental market, Airbnb is the dominant platform when it comes to short term home rentals3.

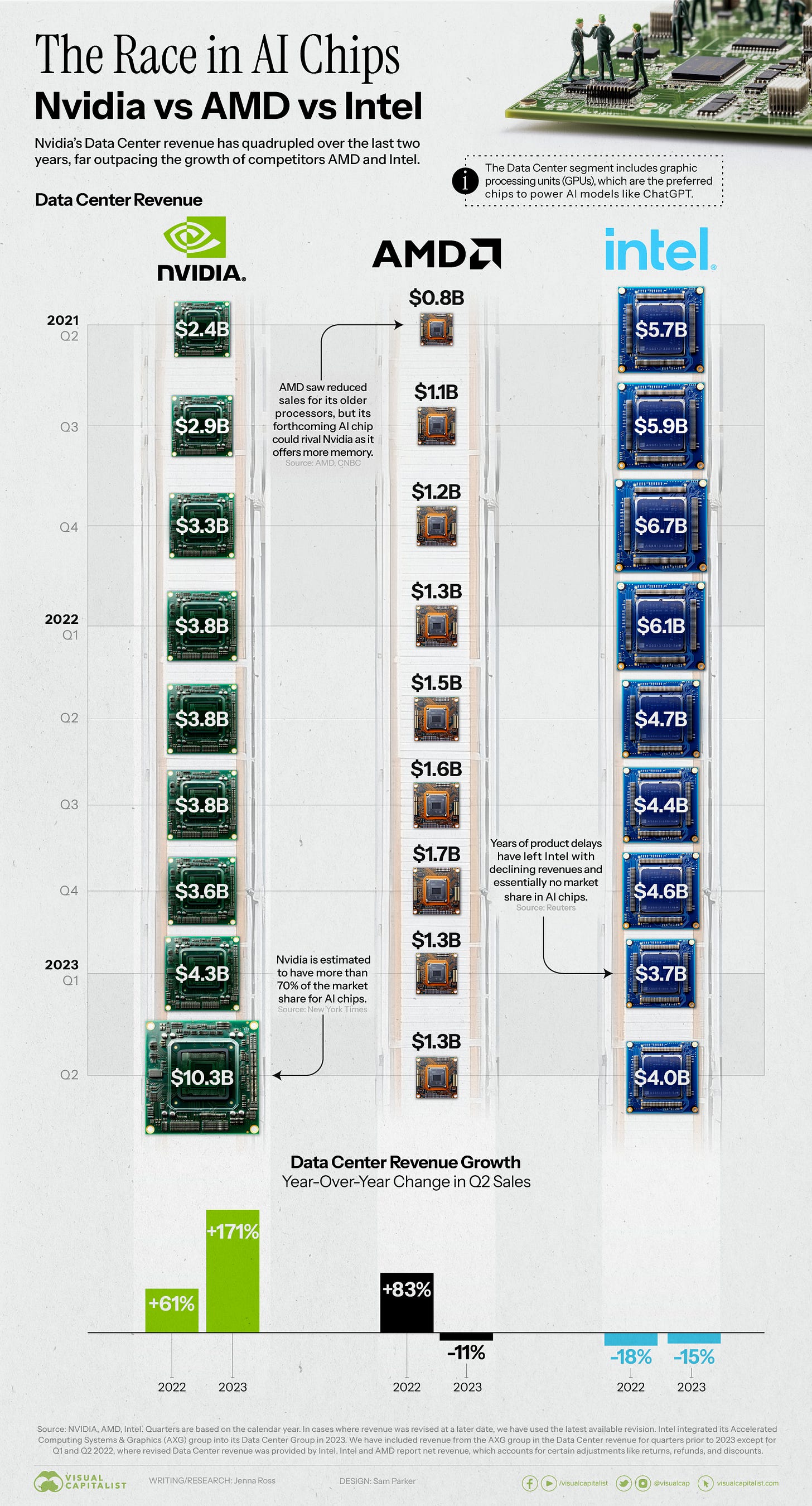

NVIDIA was far from being the first semi-conductor chip company, yet their creation of the Graphics Processing Units (GPUs), helped them reach a valuation north of 2 Trillion in 2024, worth more than the next several largest Semi-conductor chip companies combined. NVIDIA quickly went from frontrunner to Monopoly status in a remarkably short span, unless another competitor can quickly match their capabilities, they could own this for a foreseeable future.

The examples of Airbnb and NVIDIA would be evidence that Thiel is still correct that last mover advantage, defined by releasing a game changer feature is more important to achieve a Monopoly than First Mover Advantage.

Chapter 6: YOU ARE NOT A LOTTERY TICKET

“If success were a matter of luck, these kinds of serial entrepreneurs (Founders who have started multiple Billion dollar companies such as Steve Jobs, Elon Musk and Jack Dorsey). probably wouldn’t exist”.

This quote is in response to people like Malcolm Gladwell and others who attribute the success associated with launching a Billion dollar company more with luck than the individual itself. To summarize his arguments and others, people like Gates, Jobs, Musk etc. were only able to accomplish such incredible things because they came around at the right moment in history and the circumstances were such that made it possible for them to realize their ambitions. If it had not been them, likely it would have been somebody else. This is a direct contradiction to The Great Man theory which states that a few key individuals drive civilization forward.

Playing the undoing game, if Gates, Jobs or Musk had been born a century earlier, it is fair to suggest they likely would not have been tech entrepreneurs. The enabling technology did not yet exist, these men likely would have been enlisted in some military conflict and even if they managed to avoid it, they likely would have died of some disease that has since been cured my modern medicine. On the other hand, suggesting that these individuals were merely fortunate opportunists, (lottery tickets) would lead one down the path of believing that there is no point in trying to change the outcome of the future, since the future is already determined and we should simply resign ourselves to fate.

Following this line of thinking can get dark pretty quickly. Fortunately, Thiel along with the names that he mentioned, clearly did not believe this and launched multiple category defining Billion dollar businesses. Thiel posits that if luck is the key determining factor, than how could there be multiple individuals to have created multiple category defining businesses? For a company to be considered category defining, let’s assume that as of this writing, they are valued at least over $1 Billion dollars. Since the book came out, are there more examples of these kinds of entrepreneurs?

There could be more but off the top of my head, 6 people come to mind:

Parker Conrad (Zenefits & Rippling)

Max Levchin (PayPal & Affirm)

Palmer Lucky (Oculus & Anduril Industries)

Sam Altman (Hydrazine Capital* & Open AI)

Adam Neumann (WeWork & Flow*)

Travis Kalanick (Uber & CloudKitchens*)

Adam D’angelo (Facebook* & Quora*)

Brad Jacobs (multiple but most recently GXO)

It is hard to dispute that Parker Conrad, Max Levchin and Palmer Lucky achieved this status. Their companies may not be category defining at the same scale as Musk or Jobs but their sequel efforts are leaders within their respective verticals (Conrad in HR Software, Levchin in Fintech & Lucky in Modern Defense Tech).

Sam Altman is best known as the CEO of Open AI, which is undoubtedly a category defining company. Prior to his involvement with Open AI, after selling his startup Loopt, Altman founded Hydrazine Capital. According to reports, the returns generated by Hydrazine Capital, have given Altman a net worth in excess of $2B. He has regularly stated that he does not own equity in Open AI, therefore being able to amass such a net worth must mean his fund performances must be among the best performing Venture funds. If we count Hydrazine Capital as a category defining company, his brother & co-founder would also qualify for this list. Jack founded performance management company Lattice, which was recently valued at $3B.

Interestingly, the 4 first names on this list have links to Thiel. Conrad and Lucky received funding through one of Thiel’s VC funds, Levchin co-founded PayPal with Thiel. Altman and Thiel overlapped as partners at Y Combinator and Thiel was among the early backers of Open AI.

Adam Neumann definitely got WeWork to a valuation well over a billion dollars and was able to raise a substantial amount of money at a high valuation for his sequel effort, Flow but it is still premature to call it successful.

Similarly, Kalanick undoubtedly built one of the best known Web2.0 consumer companies in Uber. Not enough is known about CloudKitchens to be able to declare it a success but like Neumann, they technically are both valued over a billion dollars. It should be noted that both of these sequel ventures raised during the peak Post-Covid Venture funding bubble.

D’angelo was not technically a founder of Facebook but he was one of the first hires so I would count him in this group with an asterisk. Quora is still private, but achieved a peak valuation of $2B before a downround cut the valuation below Unicorn status. With an asterisk on both, he would be the easiest to dislodge from this list.

Brad Jacobs is not as well known as the other names on this list but he has founded seven companies—all billion-dollar plus corporations (some are spinoffs)4.

While not a founder, Frank Slootman5 managed to incredibly scale up 3 companies by more than 10X.

Data Domain was acquired for $2.4 Billion, when he joined it was doing low millions in revenue.

ServiceNow grew from $110M to $1.9B in annual revenue under his leadership

Snowflake went from $4 Billion to a peak valuation of $70 Billion during his tenure.

If you believe that the existence of founders with multiple category defining companies disproves the Lottery Ticket theory, then Thiel is correct. There are at least several founders that have managed to launch multiple billion dollar companies since Zero to One was released.

The same could be said with Microsoft Teams versus Slack. Microsoft owning such a distribution advantage over Slack could effectively give it away for free as a part of the Office bundle and simply copy Slack features a few months or years later.

Gen Z might not even know what those are

They own between 20-30% market share in the vacation rental market but upwards of 50% when it comes to short term home rentals.

He just came out with a book called “How to make a Few Billion Dollars” that might help mint a few more people to this list.

You should check out Amp it Up if you want to learn more about his operating philosophy.

Can’t wait until this quality content gets stuck behind a paywall 👀